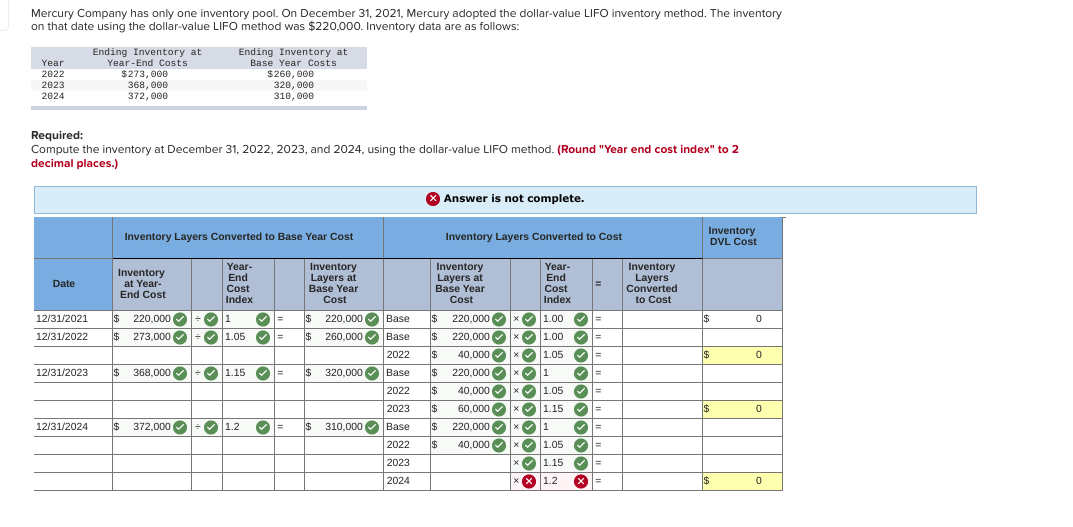

This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. According to the Dollar-Value LIFO method, the inventory value at the end of the current year is $53,000. The base year price index \( P_b \) is 1 as it's the ratio of the base year price to itself.

A layer in Dollar Value LIFO is a level of inventory that has been added to the base stock. For instance, if in year 1, you have 10 units of product A and in year 2, you add 5 more units, then those 5 units form a layer over the base stock of 10 units. The Dollar Value LIFO (Last-In, First-Out) is a business accounting technique used to manage inventory and calculate the cost of goods sold. It may seem complex at first, but as you delve deeper, you'll appreciate its utility and elegance. An eligible small business may elect to use the simplified dollar-value method of pricing inventories for purposes of the LIFO method. Vaia is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels.

Dollar value LIFO can help reduce a company’s taxes (assuming prices are rising), but can also show a lower net income on shareholder reports. This approach is not commonly used to derive inventory valuations, for several reasons. When comparing Dollar-Value LIFO to other inventory valuation methods, it’s essential to consider the unique advantages and drawbacks each method offers.

Lastly, most financial and managerial accounting courses illustrate the Dollar Value LIFO formula's application. Understanding this formula and its implications can prove beneficial to students studying accounting, as well as to business professionals wanting to have a better grip on their company's inventory management. The price index is a crucial part of the Dollar Value LIFO method that helps account for inflation when calculating the worth of inventory. It essentially shows the proportion of the cost of a certain set of goods in a particular year to their cost in the base year. In other words, the price index for a year is computed by dividing the cost of an item in that year by its cost in the base year. An inventory pool is the compilation of similar items in the Dollar Value LIFO method.

This can affect key financial ratios such as the current ratio and the quick ratio, which are used to assess a company’s liquidity. Investors and analysts often scrutinize these ratios to gauge the financial health of a business. Therefore, companies using Dollar-Value LIFO need to be prepared to explain these differences to stakeholders. Once you grasp these processes, you can significantly simplify the Dollar Value LIFO analysis, making it a go-to choice for inventory management in various business circumstances. You'll be able to provide a more accurate reflection of the cost of goods sold and deliver detailed inventory tracking – a vital element for auditors, tax preparers and other financial professionals. When creating the inventory pools, restrict changes as much as possible to enhance consistency and accuracy.

As mentioned earlier, the price index compensates for changes in price levels over time and helps convert the inventory values to constant prices, ensuring comparability amongst different years. Purchased goods' prices are rising, making their worth more than their base prices. Dollar Value LIFO would mean that the recently purchased (more expensive) goods are reported as sold first.

You group DVL pools by year, not unit, so you don't create new pools when you replace units with different ones. By maintaining the older layers, you match your COGS to the most recent purchase prices, which is the whole point of LIFO. This method assumes that the last goods added to inventory are the first ones to be sold. New layer is added ONLY if ending inventory at base-year prices is more than respective year’s beginning inventory at base-year prices.

Under the regular LIFO method, inventory is measured in units and is priced at unit prices. Under the dollar value LIFO method, inventory is measured in dollars and is adjusted for changing price levels. When converting from LIFO inventory to dollar value LIFO, a price index is used to adjust the inventory value. The process of applying the Dollar Value LIFO method might seem overwhelming at first, particularly due to its distinctive steps. However, comprehending each of these steps diligently will equip you with a practical understanding of this powerful inventory management tool. You'll eventually be capable of swiftly performing these steps and deriving accurate Dollar Value LIFO calculations.

However, it can be more complex to implement than other inventory valuation methods. Another prominent example is the automobile industry, where producers regularly update their vehicle models. They can create inventory pools by categorising their products about form 1094 based on certain variables like car type, model, or year. The Dollar Value LIFO formula can then be used to calculate the inventory layers for each category. Any organisation with a multi-item inventory facing inflation can make use of this formula.

Weighted Average Cost is another method that provides a middle ground between FIFO and LIFO. By averaging the cost of all inventory items, this method smooths out price fluctuations, offering a more stable view of inventory costs. While this can be beneficial for companies with volatile prices, it doesn’t provide the same level of tax deferral benefits as Dollar-Value LIFO. Additionally, the weighted average method can sometimes obscure the true cost of inventory, making it harder for management to make informed pricing and purchasing decisions. This method helps in matching current costs with current revenues in the income statement.